kansas sales tax exemption application

KANSAS SALES AND USE TAX REFUND APPLICATION. A sales tax exemption that will be.

For additional information on Kansas sales and use taxes see Publication KS-1510 Kansas Sales Tax and Compensating Use Tax and Publication KS-1520 Kansas Exemption.

. Failure to provide sufficient proof will result in denial of the exemption. Accessibility Policy Contact Web. To apply for update and print a sales and use tax exemption certificate.

You should begin the application process 3 to 4 weeks prior. Complete this application using the instructions that begin on page 3. Thank you for using Kansas Department of Revenue Customer Service Center to manage your Department of Revenue accounts.

Once the KsWebTax is created you will be taken to the Exemption Certificate page. Entries are required on all fields marked with an. This permit will furnish.

If you are accessing our site for the first time. WHEN AND HOW TO APPLY. Kansas Department of Revenue.

Therefore you can complete the resale exemption certificate form by providing your Kansas Sales Tax Registration Number. For example if you plan to open on January. All construction materials and prescription drugs including prosthetics.

Be either a manufacturer or able to document that most of its sales are to Kansas manufacturers andor out-of-state businesses or government agencies. Burghart is a graduate of the University of Kansas. He earned his law degree in 1979 from the Washburn University School of Law and his Masters of Laws in Taxation degree from the.

Add the city tax of 1 percent to the state sales tax of 65 percent for a total of 75 percent. For non-profits that have received a sales tax exemption certificate from the Kansas Department of Revenue the exemption certificate is good only from its effective date and can have an. Once you have that you are eligible to issue a resale certificate.

Also known as. Complete Edit or Print Tax Forms Instantly. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for.

How to use sales tax exemption certificates in Kansas. 800 524-1620 Kansas Sales Tax Application Registration. The certificate is to be presented by tax exempt entities to retailers to purchase goods andor services tax exempt.

Ad Register and Edit Fill Sign Now your KS ST-28A Form more fillable forms. Ad Access Tax Forms. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

In Kansas certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Certificate which can be provided to any vendorsupplier that shows KDA is exempt from sales tax. Select the application Add an Existing Tax Exempt Entity Certificate to.

The application must be filed with the county appraiser for review and recommendation. Most businesses operating in or selling in the state of. A non-profit is not exempt from state taxes solely because the entity forms as a non-profit or because the entity has received tax-exempt status from the.

In this case 10 times 75 is 075 so the gross receipts. Drop shipped to a Kansas location the out-of-state retailer must provide to the third party vendor a Kansas sales tax registration number either on this certificate or the Multi. Register for a Kansas Sales Tax Permit Online by filling out and submitting the State Sales Tax Registration form.

To your start date. Kansas Tax Exemption Kansas Resale Certificate Kansas Sale and Use Tax Kansas Wholesale Certificate etc. KANSAS SALES TAX PERMIT APPLICATION.

Multiply the amount of the sale by 75 percent.

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

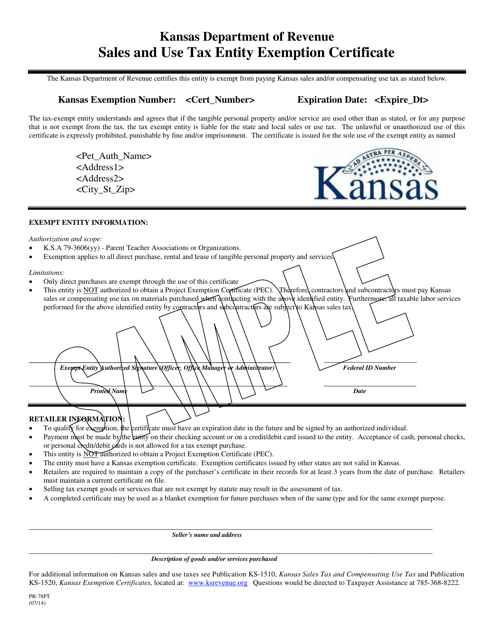

Form Pr 78pt Download Printable Pdf Or Fill Online Sales And Use Tax Entity Exemption Certificate Parent Teacher Association Sample Kansas Templateroller

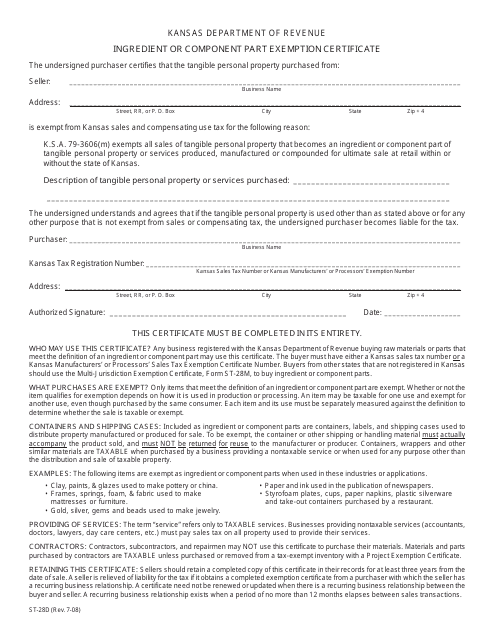

Form St 28d Download Fillable Pdf Or Fill Online Ingredient Or Component Part Exemption Certificate Kansas Templateroller

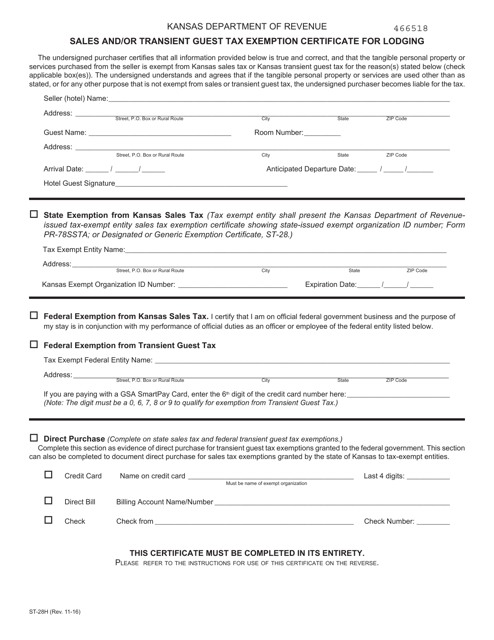

Form St 28h Download Fillable Pdf Or Fill Online Sales And Or Transient Guest Tax Exemption Certificate For Lodging Kansas Templateroller

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

Kansas Exemption Form Fill Out And Sign Printable Pdf Template Signnow

Fillable Online Baldwincity Kansas Department Of Revenue Baldwincityorg Fax Email Print Pdffiller

Kansas Resale Exemption Certificate Fill Online Printable Fillable Blank Pdffiller

Fillable Online Kansas Sales And Use Tax Exemption Certificate Um Infopoint Fax Email Print Pdffiller